Guard Against Fraud

Credit cards are a popular target for criminal activity, and debit card thieves have made headlines by stealing PIN codes directly from retailers. Remember — the rule of thumb is to protect your credit and debit cards as if they were cash. Take simple steps to safeguard yourself from fraudulent activity:

- Check your accounts online every day for unauthorized activity.

- Contact your financial institution immediately to report any unauthorized activity.

- When using your credit or debit card online, only patronize merchants that use secure websites for processing credit card transactions.

- Play it safe and avoid PIN-based retail transactions, especially at gas pumps. Rather than using the PIN pad, ask to sign a receipt instead, or select “Credit” at automated point of sale terminals.

- Never write your PIN on your card.

- Always destroy or shred expired cards, receipts with card numbers, card statements, and credit card offers. Never respond to unsolicited requests for your credit or debit card number. When in doubt, call the number on the back of your card.

Enjoy Safe, Secure Spending

With the latest chip-enabled technology and 100% liability protection on any fraudulent activity, you can enjoy total peace of mind when you use your UFCU credit or debit card:

- Your card’s chip contains information that is used only to process your transactions at a retailer or ATM. None of your personal UFCU information is encoded on the chip.

- Your debit card comes with CardKeeper™, which gives you the ultimate control anywhere, anytime through Mobile Banking. You can lock your card to disable transactions and re-enable it when the time is right.

Ensure Your Privacy

Ensuring your privacy means establishing best practices surrounding all of your personal and confidential information. You want to make sure the details around your personal life, including your social security number, PIN numbers, account numbers, credit card numbers, even your address and birthdate are not available to others.

- + How Can I Protect my Personal Information?

- Never share your password with anyone, and update it frequently. Do not use your social security number, birth date, or any other password that could be guessed easily.

- Never send personal or confidential information via email or instant messages, as these can be easily intercepted.

- Be wary of any phone call or email requesting account information that claims to be from UFCU. We will never request your account number, password, or other personal information by unsolicited phone calls or email.

- If you receive a suspicious phone call claiming to be from us, please hang up and contact Member Services at (512) 467-8080 or (800) 252-8311.

- If you receive a suspicious email claiming to be from us, do not respond to it. Instead, save the email and contact us immediately.

- Don’t click suspicious email links. UFCU will never send you any message that provides a link to your account or requests your card number, user name, or password. Every promotional email sent by UFCU will contain a unique key. If you have any concerns about the authenticity of a promotional email, please contact us so we can verify that the email indeed originated with us. If the key is missing, you may be the target of attempted fraud, and should contact us immediately.

- Physically secure your computers and devices by locking doors and windows.

- Avoid leaving your laptop, smart phone, or devices unsupervised and in plain view, especially in public spaces.

- Do not install unnecessary programs on your devices.

- Run your personal and professional online systems responsibly. Keep your software up-to-date, back up your files regularly, turn on personal firewalls, and use anti-virus software.

- Order a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) regularly. Review the reports carefully to ensure they are accurate and include only charges and activities you have authorized.

UFCU's Privacy Policy

To learn more about the how UFCU protects your personal information, read the UFCU privacy policy.

Understand Cybersecurity

Cybersecurity includes all the measures you can take to protect your computer and online systems against unauthorized activity via the Internet.

- + What Should Be in My Cybersecurity Plan?

Keep these basic tips in mind as you develop your own cyber-security plan:

- Safety applies to every user of a computer or device, adults and children alike.

- Teach your children never to post personal information or engage with strangers online.

- Establish clear rules for children about using the Internet, and create open lines of communication. Encourage them to tell you about their activities and experiences online.

- Limit the time your children spend online and create simple guidelines that the whole family can follow.

- Consider keeping computers in a common space in your home.

- + What Are Some Common Cybersecurity Threats?

There are many types of cybersecurity threats you should be aware of:

- Identity theft and fraud — Any types of crime in which someone obtains and uses another person's personal data in a way that involves fraud or deception, typically for economic gain.

- Hackers — Generally refers to any person who bypasses security measures for malicious purposes or criminal activity.

- Phishing — Emails that appear to be from a reputable business (often a financial institution) and attempt to gain personal or account information. Never enter personal information into an online form you accessed via a link in an email. Legitimate businesses will not ask for personal information online.

- Malware, short for malicious software, is any software that is specifically designed to damage, disrupt, steal, or inflict some other “bad” or illegitimate action on data, hosts, or networks. There are multiple types of malware:

- Viruses — Propagate by inserting a copy of itself into another program, so it’s installed along with that program.

- Worms — Replicate functional copies of themselves to cause damage, but do not require a host program or human help to propagate.

- Trojans — Software that looks legitimate, but is not. Victims are typically tricked into loading and executing it on their systems.

- Spyware — Also known as adware, software that may send you pop-up ads, redirect your browser to certain web sites, or monitor the websites you visit. Some extreme, invasive versions of spyware may track exactly what keys you type.

- + How Can I Help Protect Myself?

Cybersecurity is everyone’s responsibility. As a UFCU Member, you are part of our security. We ask that you practice the following fundamental online security tactics to help protect yourself:

- Update your operating systems and apps when updates are made available to make sure you’re taking advantage of the latest security features.

- Don’t log in to public WiFi networks from any of your devices. Public networks can provide potential hackers with easy access to your activity.

- Be skeptical of online relationships. Healthy skepticism can keep you safe. Don’t agree to make transfers through your credit union accounts for individuals you don’t know personally.

- Always use a secure connection. Use the UFCU Mobile Banking app or UFCU Online Banking via a secure connection to regularly check your account activity.

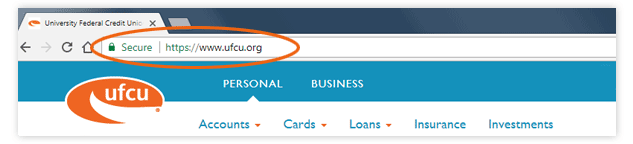

- Before you log in to Online Banking, always confirm that you are visiting our actual website (https://www.UFCU.org) as shown below.

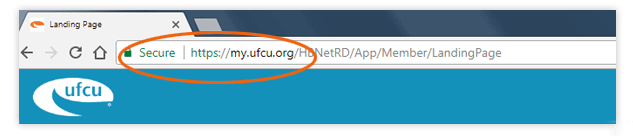

- After you have logged in to Online Banking, always confirm that you are visiting our actual website (https://my.UFCU.org) as shown below.

Unfortunately, many fraudsters attempt to mimic legitimate websites, with the intention of stealing IDs and passwords. If you're ever unsure about anything, remember that you can always contact us.